The business, professional, and financial services sectors

The business, professional, and financial sector is a highly diverse and economically significant to both the Black Country and the UK as a whole. It incorporates banks, insurance companies, management of all kinds, accountancy, legal services and beyond.

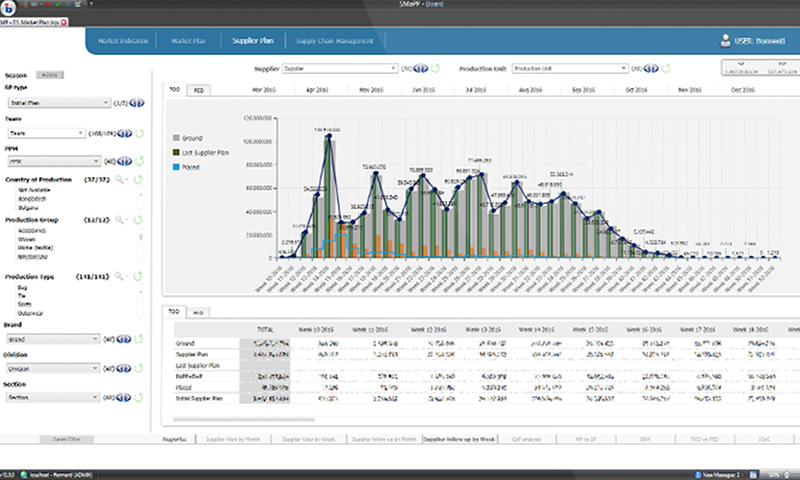

In 2020, the financial services sector contributed £164.8 billion to the UK economy, which was 8.6% of the country’s total economic output. In the first quarter of 2021, there were 1.1 million financial services jobs in the UK, making up 3.3% of all jobs.

Today, social media and online marketing is essential to almost every business, and there is a need in most companies for accountants, HR personnel, and managers.

Legal services alone are reported to be worth £60 billion to the UK economy, and account for over 1% of the UK’s labour force.

Small businesses play a big role in the health of the UK’s economy. In fact, the UK is the leading start-up nation in Europe. At the beginning of 2021 there were 5.5 million small businesses operating and by the end of 2021, UK start-ups had raised a record £29.4bn from venture capital. According to these figures, SMEs (small & medium sized enterprises) account for an amazing 99.9% of all businesses in the UK.

Types of careers in Business, professional, and financial services

There are many different careers involved in the Digital and Cyber industry, so the roles listed are not extensive.

Financial accountants are responsible for managing and reporting on the accounts of a business, while managerial accountants are responsible for analysing and communicating financial data to managers so that they are better prepared to make business decisions based on those figures.

*Average, according to Indeed

A human resources officer develops, recommends, and implements policies that help ensure the effective use of staff. Responsibilities of HR officers include working practices, pay, employment conditions, equality, recruitment, and more.

* Average, according to Reed

A business manager supervises and develops numerous aspects of a business, and is responsible for ensuring that a company runs smoothly in order to make sales. This can include developing business plans, enhancing customer service and satisfaction, sourcing new business, interviewing new candidates, and ultimately being accountable for both business success and failure. This can include management in areas as varied as tourism management, marketing management, event management, hospitality management, and beyond.

Solicitors provide expert legal support and advice, helping clients to take the legal course of action that is right for them. Solicitors can focus their careers on commercial work, personal issues, and protecting personal rights with regard to be treated fairly, while areas of expertise may include employment, property, tax, family and children, immigration, human rights and more.

*Starting salary, according to Prospects

Marketing roles can vary from entry-level positions such as a marketing executive up to heads of content and directors of marketing, and involve promoting a product, service, company, or idea through a multi-channel approach.

Economic forecasts show further growth in financial services over the next decade, and London was ranked second in the world for its financial market’s competitiveness. While jobs and business have likely been lost to other financial centres as a result of the UK leaving the European single market, it appears that the impact may not be as severe as many initially feared.

Marketing is essential for every business, and as work has moved online for many people and companies, meaning that the need for marketing experts will continue. In the UK, digital marketing spend grew by 9.6% between 2020 and 2021.

Out of all the main industries, the professional and financial services is the most significant contributor to the West Midlands’ regional economy, and the most significant employer of high-quality jobs, with 15% of the jobs in the Black Country – that’s 73,000 roles – belong to this sector.

Wages for jobs in the professional sector (including human resource managers, finance officers, management consultants, business analysts and office managers) remain competitive in the region and comparable to the national average for the sector.

/prod01/wlvacuk/courses/media/images/2019-re-design/blurb-block/2019-content-types-banner.jpg)

Our expertise and facilities

The University has provided over 80 years of business education. Our lecturers aren’t just academics – they have worked and owned businesses in the industry. They use their practical and professional expertise when teaching and illustrating different professional, financial, and business scenarios.

Courses are underpinned by a vision made up of four pillars: sustainability; responsibility and professionalism; entrepreneurship; and innovation. While our priority is with or students, our vision extends to local businesses and community.

The University of Wolverhampton Business School, based at the Lord Swraj Paul Building, is a six-storey centre home to an executive education suite, innovative teaching and learning spaces, and IT suite, consulting rooms, and a central social space and café.

Our links with industry

Our courses are also accredited by prestigious professional bodies, meaning that your qualification is internationally recognised by employers, helping you to progress in your chosen profession.

A Chartered Institute of Personnel and Development (CIPD) approved centre, we offer degrees accredited by the Association of Chartered Certified Accountants (ACCA), Chartered Institute of Management Accountants (CIMA), Chartered Institute of Marketing (CIM), Chartered Management Institute (CMI), and Institute of Chartered Accountants in England and Wales (ICAEW) among others.

We have excellent partnerships with industry and strong links with professional bodies such as the Institute of Directors (IoD) and the Institute of Leadership and Management ILM.

Whether you’re looking to study law as a useful tool for your future plans, or are intent on qualifying as a solicitor or barrister, you’ll find Wolverhampton Law School will support your ambitions. By getting involved with many of the initiatives to help boost your employability, including our DWF mentoring scheme and working in our Legal Advice Centre, you’ll find you’ll be well prepared for roles including auditor, paralegal, probation officer, solicitor, and more.

World Class Facilities

World Class Facilities

FAQ's

Your FAQs about pursuing a career in Business, professional, and financial services.

Many people who work in professional services join in junior roles and work their way up, becoming more trained as they progress, often studying part-time courses combined with work, or with work placements.

Alternatively, you can study for an undergraduate degree in the area you’re interested in – many have accreditation from the appropriate professional organisation, such as the CIPD, or CMI.

There are an increasing number of apprenticeships available in professional services, where you’re employed in an organisation, and study for an apprenticeship whilst working.

Each professional area will require sector-specific qualifications – however most will require you to prove you have basic literacy and numeracy skills at entry/junior level as a minimum. To enter into many professional careers eg. in law or accounting, you will need degree-level or professional qualifications, such as our LLB (Hons) qualifying law degree, or multi-accredited BA (Hons) Accounting and Finance.

There are many different roles within professional services, in many industries. Almost every organisation or company you can think of will have roles to fill in HR, finance and marketing. There are excellent opportunities for progression, and opportunities in both the public and private sector.

Many professional roles, such as those in law, or working for charities can allow you to make a positive difference in people’s lives. If you’re an aspiring entrepreneur, there are also excellent opportunities to be your own boss and set up your own business.

For the majority of professional roles you will gain most experience either on-the-job working in a company, or through work placements during your studies eg. working in our Legal Advice Centre if you’re studying law with us.

When applying for any job or course, having some work experience in the area you’re interested in is a useful way to prove your enthusiasm and commitment to your studies or career ambitions. You could try arranging work experience through your school or college, through someone you know, or by approaching companies directly. Some may offer paid or unpaid internships as well as work experience.

If you’re at school or college, you may be able to arrange a work experience placement in a suitable company or sector. If you’re one of our students, most courses include relevant placements and experience, however you can also explore all the opportunities, including part-time jobs, sandwich placements, work experience, international opportunities, graduate and volunteering positions from Careers, Enterprise and the Workplace.

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-18-19/iStock-163641275.jpg)

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-2024/250630-SciFest-1-group-photo-resized-800x450.png)

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-18-19/210818-Iza-and-Mattia-Resized.jpg)

/prod01/wlvacuk/media/departments/digital-content-and-communications/images/Maria-Serria-(teaser-image).jpg)

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-2024/241014-Cyber4ME-Project-Resized.jpg)

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-18-19/210705-bric_LAND_ATTIC_v2_resized.jpg)

/prod01/wlvacuk/courses/media/images/2019-re-design/video-banner/homepage_postgraduate-week.jpg)